Digital currencies to be credit negative for banks

ANI

13 Sep 2021, 15:48 GMT+10

Singapore, Sep 13 (ANI): Wide adoption of central bank digital currencies (CBDCs) in cross-border payments and settlements will be credit negative for banks because of lower fees and commissions, Moody's Investors Service said on Monday.

This is particularly for those banks that are active in foreign-currency payments, clearing and remittances, it said in its latest credit outlook report.

It is the first time that the Bank of International Settlements (BIS) and various central banks are testing multiple CBDCs in a single platform for cross-border settlements.

This is an important step if CBDCs are to be adopted beyond domestic transactions. Earlier in 2021, the Singaporean and French central banks successfully tested dual-CBDC cross-border transactions, said Moody's.

On September 3, the BIS together with central banks of Singapore, Australia, Malaysia and South Africa started testing CBDCs for cross-border settlements.

The project called Dunbar aims to build a prototype platform for settlement in multiple CBDCs with the target being faster, cheaper and more secure cross-border payments and settlements between financial institutions.

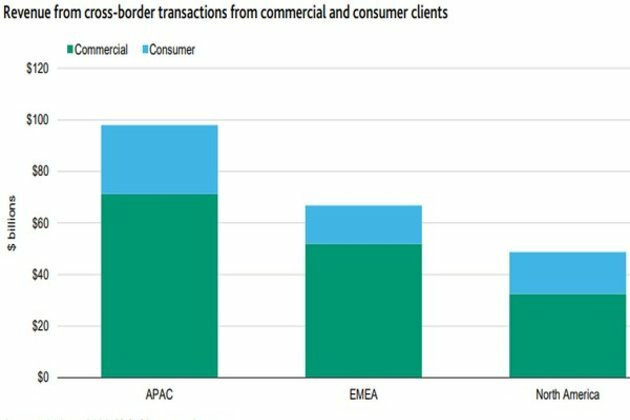

Moody's said the revenue that banks generate from cross-border transactions is significant. Globally, banks generated about 230 billion dollars in revenue from cross-border transactions in 2019, based on data from consulting firm McKinsey.

Banks in Asia Pacific made up 100 billion dollars of this amount, the largest share globally, with most revenue coming from commercial transactions such as bank-to-bank.

According to McKinsey, banks globally generated about 60 billion dollars in revenue in consumer business in 2019 for cross-border transactions such as remittances, where the banks charge hefty fees.

Banks on average charge 6.4 per cent on outward remittances, based on World Bank data, with Nigerian, South African and Thai banks charging some of the highest fees globally. These fees will be reduced with the wider adoption of CBDCs.

It is uncertain if the platform prototypes developed under the Dunbar project will be adopted by other central banks. However, the BIS expects that the results of this project will guide the development of global and regional platforms for more efficient cross-border payments. (ANI) Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Leeds Times news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Leeds Times.

More InformationEurope

SectionMet Éireann warns 14 Ireland counties of weekend heatwave

DUBLIN, Ireland: Temperatures reached 28 degrees in some parts of the country on July 11, and a yellow weather warning is now in place....

Sources: Meta won’t alter data model, faces fresh EU charges

BRUSSELS, Belgium: Meta is holding firm on its controversial pay-or-consent model, a move that could lead to fresh antitrust charges...

Swimmers in Ireland urged to beware rip currents amid hot spell

DUBLIN, Ireland: The Royal National Lifeboat Institution (RNLI) has issued a strong safety warning ahead of this weekend's expected...

Trump administration restarts Ukraine arms deliveries

WASHINGTON, D.C.: The Trump administration has started sending some weapons to Ukraine again, just a week after the Pentagon told officials...

Irish Rail faces 26,000-euro bill after graffiti spree by man

DUBLIN, Ireland: Irish Rail incurred over 26,000 euros in damages due to a series of graffiti incidents carried out by a 24-year-old...

Warsaw responds to migration pressure with new border controls

SLUBICE, Poland: Poland reinstated border controls with Germany and Lithuania on July 7, following Germany's earlier reintroduction...

International

SectionSources: Meta won’t alter data model, faces fresh EU charges

BRUSSELS, Belgium: Meta is holding firm on its controversial pay-or-consent model, a move that could lead to fresh antitrust charges...

Trump’s tariff push could push US rates above 20%, ICC says

LONDON, U.K.: American consumers and businesses could soon face the highest overall tariff burden in more than a century, according...

U.S. Urged to Investigate After Israeli Settlers Beat Palestinian-American to Death

The family of Sayfollah Saif Musallet, a 20-year-old American citizen who was beaten to death by Israeli settlers in the occupied West...

New Hampshire federal court ruling defies Trump’s citizenship move

CONCORD, New Hampshire: A federal judge in New Hampshire issued a crucial ruling on July 10 against President Donald Trump's executive...

Houthis attack cargo ship in Red Sea, raising maritime safety fears

DUBAI, U.A.E.: A cargo ship flagged under Liberia, known as the Eternity C, sank in the Red Sea following an attack executed by Yemen's...

Trump administration restarts Ukraine arms deliveries

WASHINGTON, D.C.: The Trump administration has started sending some weapons to Ukraine again, just a week after the Pentagon told officials...